The Finance Act contains necessary amendments in the direct taxes (e.g. income tax and wealth tax) and indirect taxes (e.g. excise duties, custom duties and service tax) signifying the policy decisions of the Union Government.

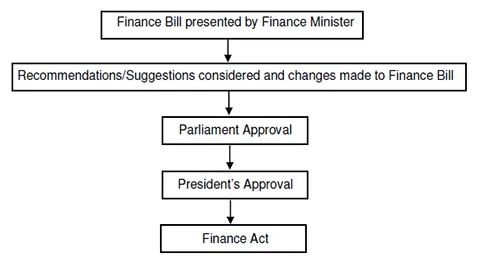

Finance Bill is presented usually in the last week of February every year and this bill contains amendments in direct as well as indirect taxes. It is usually presented in the Parliament by the Finance Minister.

The finance bill is passed by both the houses of Parliament after it is being tabled and necessary recommendation / amendments have been made in it. Once this bill has been passed by the Parliament, it goes to the President for his assent. After President assent, the finance bill becomes the Finance Act.

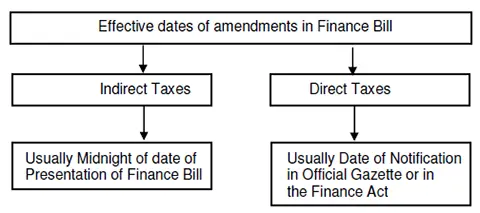

The effective date of applicability of provisions of the Finance Act is usually mentioned in the notification in the official gazette or in the Act itself. Generally, the amendments by the Finance Act are made applicable from the first day of the next financial year e.g. generally, amendments by Finance Act, 2013 are effective from 1st April, 2014. Regarding indirect taxes, the ad valorem tax rates (tax rates based on value) are effective from the midnight of the date of presentation of the Union Budget.

Invest wise with Expert advice